As a business owner, you may experience mixed feelings when it comes time to get your small business ready for tax season.

Tax season is a stressful time for many of us personally, but add business to the mix? It’s a whole other world!

With receipts scattered, documents misplaced, and procrastination looming, it’s no wonder we avoid all tax-related tasks until the last minute.

In this blog post, I’m sharing my simple organizing strategies honed over two decades. With these systems in place, you can keep your taxes organized for both personal and business use year after year.

Let’s dive into the five best tips to kickstart a stress-free tax season!

How to Get Your Small Business Ready for Tax Season

Centralized System for Receipts:

Organizing receipts is crucial for a smooth tax filing process. Designate a specific spot in your wallet, desk, or car for collecting receipts. Use durable zipper pouches labeled with categories like “Business Expenses” or “Medical Receipts” for easy sorting and retrieval. Regularly empty these pouches into your central tax folder to keep everything tidy and in one accessible place come tax season.

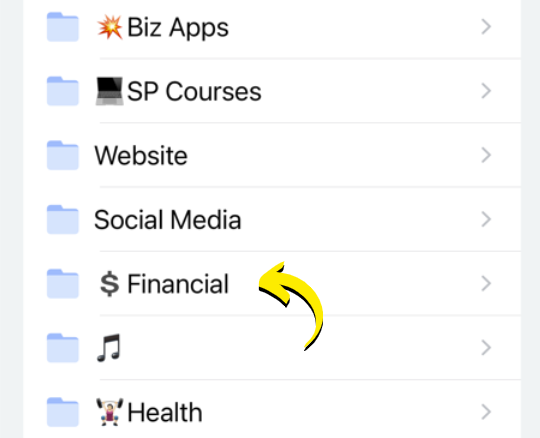

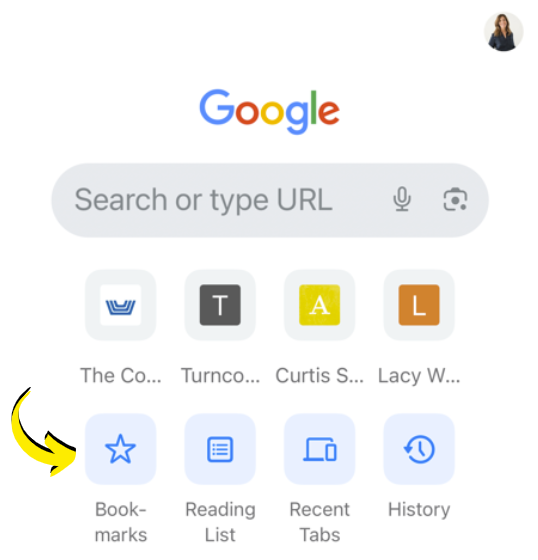

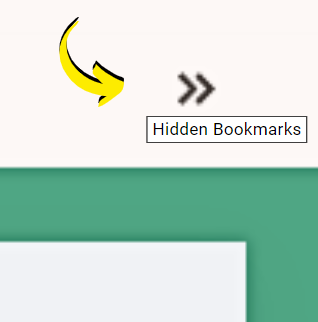

Digital Tax Folder:

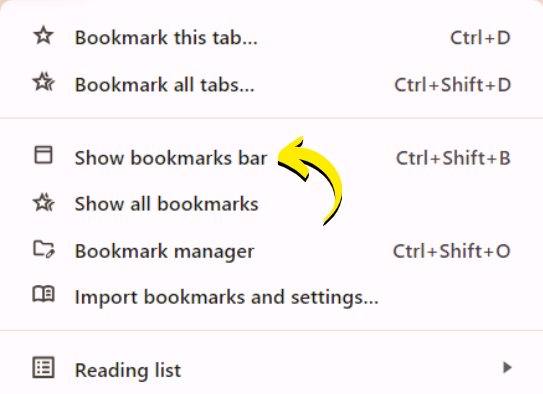

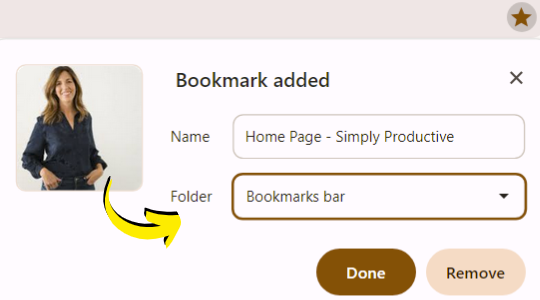

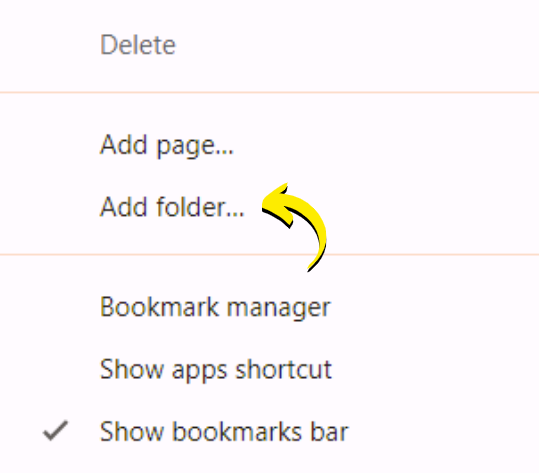

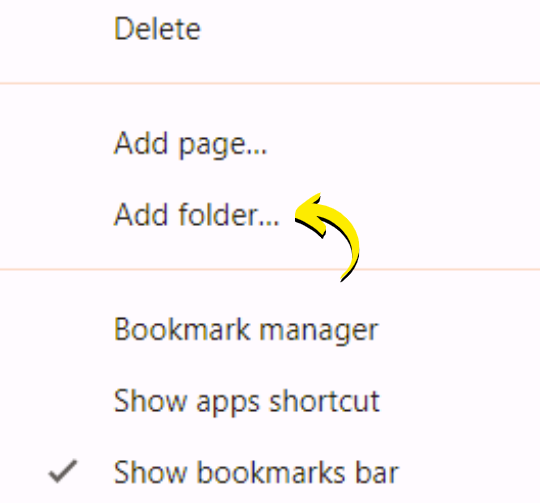

Since we’re living in the digital age, it’s beneficial for you to digitize as many documents as you can to get your small business ready for tax season. Start by creating dedicated tax folders on your computer for both personal and business taxes. As you receive documents, scan or photograph them and file them directly into their respective folders. This ensures a well-organized digital archive for easy reference whenever you need something!

Personalized Tax Checklists:

Develop customized tax checklists for your specific needs. You can find free basic templates online to start with and just tweak them where needed. For business owners, maintain separate checklists for personal and business taxes. Customize these lists to streamline the gathering of required documents for tax season.

File Folders with Expanding Pockets:

If you haven’t already, choose a filing system that suits your needs. File folders work well for smaller amounts of documentation while folders with expanding pockets are ideal for larger volumes. To get your small business ready for tax season and beyond, prepare labels for upcoming years to save time in the future and recycle old folders as needed. This ensures a seamless transition from one tax year to the next!

Archive System:

Establish an archive system for past tax years. Keep only the current year and the two previous years in your immediate workspace for reference. Use labeled hanging files or expanding file pockets for each year to separate and store them in a designated area, such as a home office or storage space. Make sure these paper documents stay safe from damage by moisture or any other potential cause by using at least a banker’s box or even fire-proof storage.

Now you’re prepared to get your small business ready for tax season!

Implementing these organizing tips will transform your tax season experience from a last-minute scramble to a perfectly planned filing time!

From simply managing receipts to creating a digital archive, personalized checklists, and an efficient paper-to-digital filing system, you’ll be well-prepared for stress-free tax filing year after year.

Remember, the key is consistency. Find a system that works for you, customize it to your needs, and stick with it. The more you switch around your system the easier it is for pieces to fall through the cracks.

As tax season approaches, you’ll appreciate the ease and efficiency of having all your documents in order!

If you have secret tips of your own or more questions about how to get your small business ready for tax season, feel free to share them in the comments below!

Like this article?

You’ll love this one👇🏻

When to Hire a Productivity Coach or Professional Organizer

Not sure where to start with business organization?

Sign up for my free newsletter so I can send you the best organizing tips and strategies each week.

(and some freebies, too!)